Once again Team EAIB saved all its readers from getting trapped in the manipulator's plan. We

told you all last week that manipulators will energize the bulls & will bounce back after

taking the markets lower down to around 5320 levels. Last week whole

world watched Nifty fut crashing down to around our support level of 5320

& then rallying higher to 5542 levels but not crossing our

resistance 5555 decisively on closing basis & once again crashing down sharply again later . So on both sides our readers minted massive amount

of money & enjoyed the bull-ride & bear attack both!! Thats the

power of market outlook provided by Team EAIB.....we can make you earn

in any kind of market with our highly accurate-authentic market view

& trading calls.

Read the facts provided for knowledge & use your own wisdom to trade in this market .

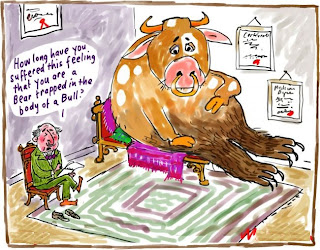

This

market is absolutely manipulated and is the play ground of

manipulators & crooks.... it seems to us that the current market

move is a constructed and engineered effort by the manipulators to

create frenzy of buying. The goal seems to be to get in as much naive

public retail money as possible. Manipulators create false buying to

trap the sheeps (retail traders) & then buy tanking the markets

later they create money bi-directionally & sheeps who are unaware of

the game plan lose money on both side trades!! For us sheep though,

we want to know when that is… so we can get short ahead of them!

However, only the insiders are given that information, so we’ll just

have to keep on guessing for now.

In last few weeks we have seen market showing highly deceptive moves

& a roller coaster movement. All retail traders who was unknown or

was not having any good adviser, were unable to catch the direction of

the market & 90% traders got stop loss triggered on both sides.

Till now bulls are trying hard to

sustain above 5260 mark on closing basis, but If it doesn’t by some odd

reason, and it consecutively closes below the 5260, then we will need another

conforming close below it before we’d be comfortable saying “the bear

is back” & then we expect a 75-165pts downside movement (from 5260

level) in markets. Revengeful bears can also brutally murder the bulls

& then this downside move can come in a single trading session

also. Till markets are above 5260 level, bulls will regain their energy

to fight back with the bears & show bounce back. However, we no

longer live in a “free society”, where the stock market is actually

traded freely with real buyers and real sellers. Now we have a market

that is totally controlled by manipulators, so anything anytime

unexpectedly can happen & change the whole scenario.

Moving

onto higher side the short term hurdle for bulls will be at 5455-5555, as we have

mentioned the importance of these levels in earlier few weeks also. And

whole world watched Nifty fut reverting back down sharply from this

range. Once we write the levels & Nifty future shows the importance

in actual movement....whole India comes out shouting about those levels.

If this resistance zone is crossed by bulls on consecutive closing

basis we will see them flying like a Superman!!!!

Read the facts provided for knowledge & use your own wisdom to trade in this market.

For the week starting from 19March, Nifty fut will face resistance

at 5365 level, and in order to maintain uptrend and keep hope for bulls

alive, it has to close above this level for consecutive days. Once

Nifty fut manages to close above this level, we can see upper levels

till 5398-5455-5514 levels. However Nifty fut will face good selling

pressure on rise and will need good volumes to cross 5365 levels,

failing to do so and closing below 5260 levels, it will again slide

down to lower levels. On lower side Nifty fut have support at 5260

level, if it breaches this level and closes below this then expect some

sudden sell off to come and that will take down Nifty fut to much

lower levels of 5190-5135-5084. So, the initial trading session of this

week will be of greater importance to decide the further movement of

markets. Traders must stay cautious and take positions after watching

the market scenario. Overall range for the markets the narrower range

is 5260-5365, ans a brodaer range looks like 5135-5514 however on

higher limit of these ranges, chances for sudden profit booking will be

of high probability.

We recommend all traders to watch the range 5260-5365, as this range is

very crucial for this week, breakout of range on closing basis on

either side will lead to sharp movements. So, trading strategy must be

made only after watching this range. On lower side 5260 is support, & if Nifty dont breaches 5260 level on closing basis, then

we can see bounce back in markets from lower levels, on higher side 5365-5398 is resistance zone. In this March expiry we may see some

steep movements in markets and markets may show some clear one side

direction. Traders are adviced to hedge all the positions accordingly,

and dont trade blindly without judging the market movement.

Read the facts provided for knowledge & use your own wisdom to trade in this market.

Intraday Calls

For LIVE MARKET CALLS, Click here.

For

all trades, keep trailing your stop loss once the stock is above

the buying price. Don't take delivery of any intraday call. Avoid

spike buying.

================================

For live market updates and stock calls, add our yahoo id- eaibsecurities@yahoo.com

Only accuracy here!!!!!

For any queries, Contact us at-

E-mail : eaib.securities@gmail.com

Mobile No.: 09935466303